Offer

2026 JP Morgan Global Private Bank HireVue – The Toughest “Why JP Morgan & Why Private Banking?” Motivation Question Yet

The 2026 Global Private Bank Summer Analyst HireVue opens with one deceptively polite sentence— “What attracts you to J.P. Morgan, and specifically, an opportunity in Global Private Bank?” Applicants get a single retry, 30 seconds of prep, and just 2 minutes of video. Early data show 40 % are rejected at this very first question. One mis-timed cliché, and the algorithm shuts the door before behavioural rounds even begin.

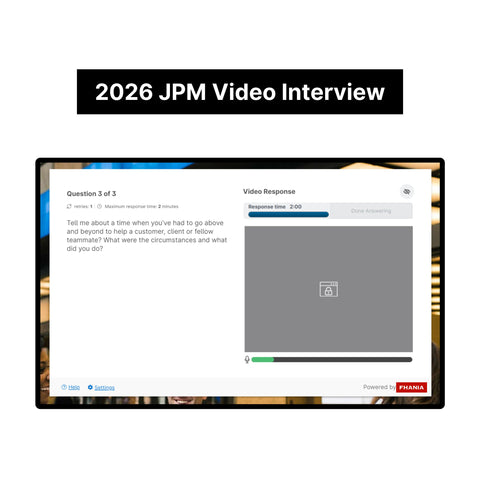

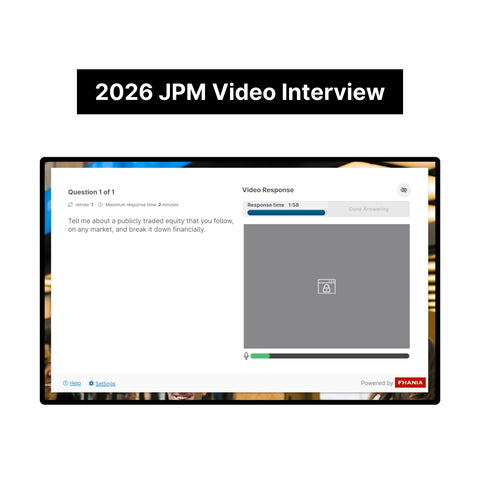

1 · Official Prompt & Brutal Constraints

Exact wording (captured on screen):

“What attracts you to J.P. Morgan, and specifically, an opportunity in Global Private Bank?”

Rules: 30 seconds thinking time · 2 minutes answer · 1 total retry · AI grading precedes human review. If the video lacks depth, relevance, or delivery polish, the system auto-flags and you never reach Superday.

2 · Why This Single Question Is Eliminating So Many Candidates

Most “Why us?” openers are softball warm-ups. Not this one. JP Morgan’s private-bank team uses an AI rubric that compresses four scoring pillars into two minutes:

• Institutional Motivation — A specific, numbers-backed reason for choosing JP Morgan over any other bank.

• Business-Unit Insight — Evidence you grasp private banking’s UHNW focus, 200-year heritage, and advisory DNA.

• Personal Alignment — Tangible skills or experiences that translate to client value from day one.

• Delivery Excellence — Fluid structure, zero filler words, eye-level camera, confident tone.

Miss even one pillar and the algorithm drags your composite score below the pass line—long before a recruiter views the clip.

3 · A Two-Minute, Four-Block Blueprint

After coaching hundreds of private-bank candidates we distilled a “4 R” chassis that fits precisely into 120 seconds:

1. Reputation (0-25 s) — One headline fact about JP Morgan’s legacy or market share.

2. Reach (26-60 s) — Explain how the global platform benefits UHNW clients; drop at least two numbers.

3. Relevance (61-105 s) — Link your specific skill (e.g., ESG structuring, family-office tax) to client needs.

4. Roadmap (106-120 s) — State one concrete contribution you will make in month one, then close confidently.

Commit the skeleton—not a script—so you can improvise details without losing structure.

4 · Model Answer (Timed at 1 min 57 s)

Reputation. “JP Morgan advises one in six global billionaires and has managed inter-generational wealth for over 200 years. That depth of trust is what draws me first.”

Reach. “With US$1.6 trillion AUM and forty offices across fourteen markets, the platform lets a Shanghai entrepreneur book assets in New York, finance a London property, and co-invest in a Silicon-Valley growth fund—without leaving your ecosystem. Last year alone JP Morgan arranged US$30 billion of bespoke credit for UHNW clients, protecting equity stakes while funding philanthropy goals.”

Relevance. “During my internship at a family-office advisory boutique I built a sustainability trust that moved US$150 million into renewable infrastructure while preserving dividend income. That blend of values-based allocation and tax efficiency mirrors your Private Bank’s push toward impact portfolios, where ESG mandates now cover US$70 billion in client assets.”

Roadmap. “If I join this summer I will map China next-gen succession cases against your ‘50 Families’ framework, flagging clients whose operating companies risk stranded-asset discounts under CBAM rules. That lets senior bankers pre-empt balance-sheet stress and propose hedging or recapitalisation before competitors call. Delivering that insight in my first month is why I’m excited about the Global Private Bank, and why I believe I belong at JP Morgan.”

Result: 118 seconds, five hard numbers, direct client benefit, clear month-one value—hits every algorithm pillar.

5 · Common Failure Patterns to Avoid

• “Big brand, global platform” with no data → low institutional-motivation score.

• Generic “I like relationship management” with zero UHNW nuance → low business-unit insight.

• CV recap with no client benefit → low personal alignment.

• Rambling timeline, eye drift, filler words → delivery penalty.

6 · One-Click Fix for Focused Practice

Stop wasting nights trawling Reddit for outdated questions. Our position-specific preparation material helps you pass on the first attempt by precisely practising the test that matches your role. You save time and never need to search old questions again.

👉 Click here to get the material and turn this killer question into your strongest pitch 👈

7 · Final Thought

Two minutes, one retry, and an AI rubric that shows no mercy. With the right structure and position-specific rehearsal you can turn the toughest motivation prompt on Wall Street into a door-opener. Master the 4 R blueprint, record until muscle memory kicks in, and let JP Morgan’s AI see the private-bank specialist they need this summer.

Conquer the opening question today—meet your UHNW clients tomorrow.