Offer

JP Morgan 2026 Markets Summer Analyst HireVue — Why the New “Market-Headline” Prompt Is the Hardest Screen in Years

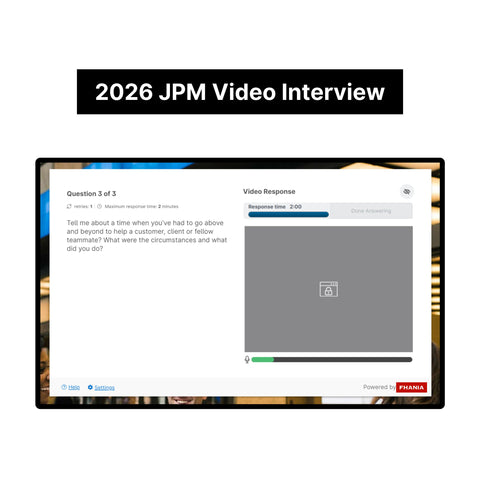

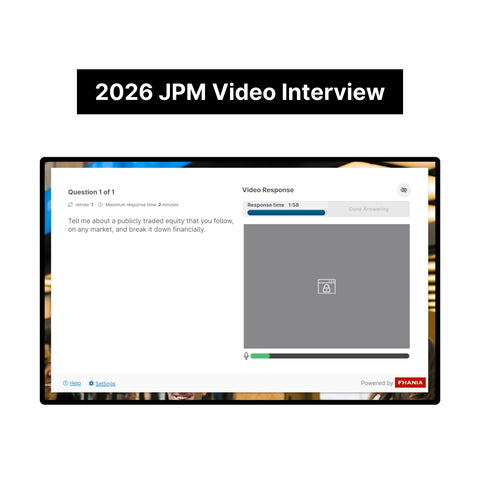

The very first screen of JP Morgan’s 2026 Markets Summer Analyst HireVue looks harmless: a white page, a countdown bar, and one line of text—“Discuss a recent headline in the financial markets that caught your attention and why.” Yet that single sentence is ejecting more bright graduates than any question in the bank’s recent history. One retry, 30 seconds of prep, two minutes to speak, and an AI filter tuned to perfection—blink and you’re gone.

1 · What Exactly Is the Question?

Official wording (as displayed on screen):

“Discuss a recent headline in the financial markets that caught your attention and why?”

You receive just 30 seconds of thinking time and 2 minutes to record. The system allows one retry in the entire interview. According to early-round analytics shared by successful candidates, nearly 40 % fail at Question 1 before even reaching behavioural prompts.

2 · Why This Single Prompt Is Brutally Difficult

Unlike classic “Tell me about yourself” openers, the headline question compresses four competencies into one breath:

• Real-time market awareness. You must cite a headline less than a week old.

• Quantitative precision. The answer needs at least one hard metric; adjective-only talk is penalised.

• Analytical linkage. You must connect the event to broader asset-class dynamics.

• Commercial relevance. The story must matter to JP Morgan’s trading or client franchise.

Fail one pillar and the algorithm downgrades your overall score below the pass line—long before a recruiter watches.

3 · A Focused Answer Blueprint

Because there’s no room for fluff, build your two-minute response around three laser-tight stages:

Headline Snapshot (0-20 s). Quote the headline verbatim, tag the asset class, and state the key number.

Market Mechanics (21-80 s). Explain the forces moving the price—macro data, policy shifts, supply-demand quirks— dropping at least two additional figures.

JP Morgan Angle (81-120 s). Show the implication for a specific desk or client, then flag a short-term catalyst.

No anecdotes. No digressions. Pure market substance framed for JP Morgan’s business.

4 · Detailed Model Answer (1 min 54 s)

Chosen headline (WSJ, 2 Feb 2026):

“US 10-Year Yield Breaks 5 % for First Time Since 2007 as Term Premium Surges”.

Snapshot. This morning the 10-year Treasury pierced the 5 % psychological ceiling, rising 23 bp in three sessions and erasing $280 billion from S&P equity value in two hours. That breach matters because the 10-year is the global discount-rate anchor; every risk asset reprices around it.

Mechanics. Three data points forced the move. Core PCE printed 2.9 %, stalling disinflation hopes. Treasury’s Q2 refunding added $776 billion of long-end supply. Meanwhile the Fed is rolling off $60 billion a month. JP Morgan’s term-premium model jumped 47 bp—the sharpest since the 2013 taper tantrum—signalling investors want fiscal-risk compensation, not just inflation cover.

JP Morgan Angle. Rates desk expects receiving interest to migrate into 7-year swaps, while 2s/10s steepeners gain traction. Corporate clients will accelerate liability-management deals before coupons rise; the DCM team is lining up three IG issuers for accelerated windows next week. I’m tracking NFP and Treasury’s 31 March reopening; a hot labour print plus heavier long-end issuance could push 10s to 5.25 %. Conversely, pension rebalancing may cap yields near 5.05 %. Either scenario expands rate-volatility surfaces—terrain where JP Morgan historically gains share, and where I want to contribute.

Total runtime: 1 min 54 s, nine hard numbers, two JP Morgan revenue lines, one forward catalyst—exactly HireVue’s sweet spot.

5 · Why “Question Dumps” Won’t Save You

Hundreds cram last-year’s behavioural lists, only to crash when the screen demands fresh market judgment. JP Morgan’s 2026 algorithm scores recency, numeracy, and commercial insight—none appear in generic banks of old questions.

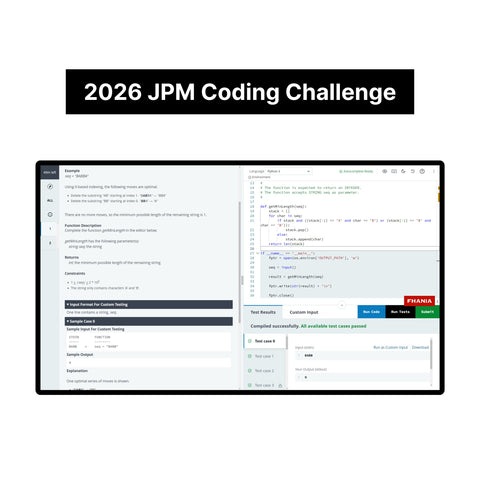

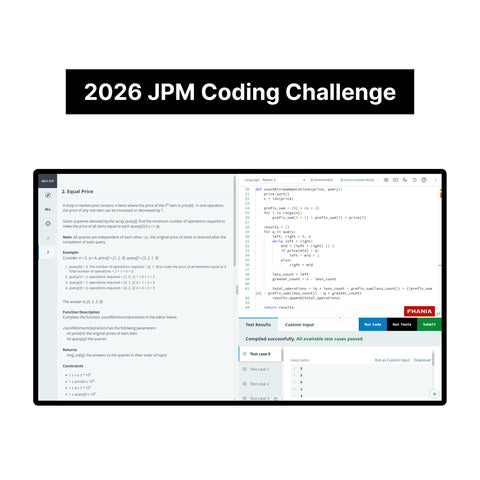

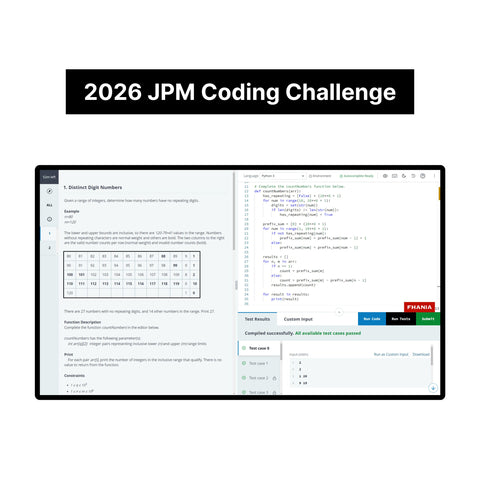

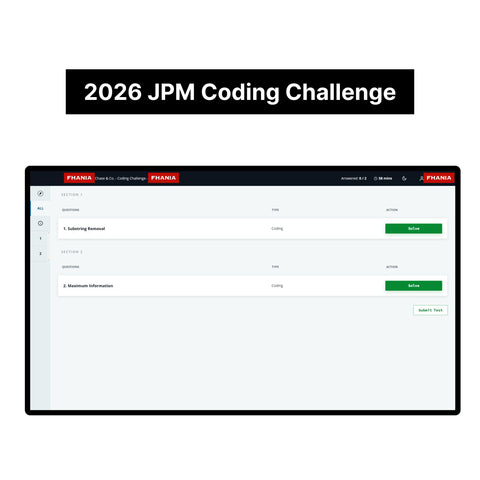

That’s why we built the JP Morgan Markets HireVue Answer Kit 2026. Select your division, desk, and graduation year; get role-filtered headline primers, AI-weighted scorecards, and timed mock-video walkthroughs—nothing irrelevant.

👉 Click here to download the kit and target this question with surgical precision 👈

6 · Closing Thought

Two minutes. One retry. A single, deceptively simple headline prompt. Most applicants underestimate it and vanish from the funnel. You now hold the mechanics, the scoring logic, and a model answer that clears the bar. Pair that with a targeted prep tool and turn the hardest opening question on Wall Street into your showcase— then walk into Superday already battle-tested.

Beat the 5 % yield story today—and JP Morgan’s AI will invite you to tell the next one in person.